Being a Delhiite, I am a big foodie. I like to roam around different places on weekends just to taste some lip smacking food. I always prefer to choose a restaurant, which offers good quality food. The first thing I look at the restaurant menu is FSSAI registration mark. FSSAI logo certifies that the restaurant food is safe and its quality is good for the health.

Many restaurants perceive the FSSAI license, which certifies that the restaurants have the permission from the FSSAI department to sell food products. For food businesses, FSSAI is used as a marketing tool to increase business. In this article, we are going to discuss the impact of FSSAI food licensing & the FSSAI registration system on your restaurant business.

- FSSAI is the certificate of purity

Most food outlets and restaurants avoid FSSAI food licensing to save time and money and to avoid the hectic process of documentation. But this license saves you against the legal actions against the restaurant in case of food poisoning, allergic reactions, etc. FSSAI license is essential and attaining it, is very simple with the help of legal consultancies. They will charge normal fees and you will get the license at your door step with minimal documents.

- Helps in business expansion

If you have a renowned restaurant chain and you want to expand your business in different locations of the country, then get the FSSAI on an urgent basis. The license will also help you to get a loan and funding from the bank for the expansion. Your restaurant chain will be widely accepted by the new customers also. You can use the FSSAI logo on your bills and restaurant menus to enhance your relationship with customers.

- Expand your reach to corporate

Getting the big ticket for the events of corporate is quite tough for restaurants due to their strict and tight regulations. All corporations, like to give the food tender to the restaurant, which has FSSAI food license, as it is the certification of good quality. So, FSSAI license is as important as the other essential papers required to get permission for operating the food business in the event peacefully.

- Standardization of kitchen

FSSAI expects that every food outlet, which is certified under the authority, should follow certain rules and regulations, procedure and processes to maintain a standard of hygiene in the kitchen. The guidelines of FSSAI can help the restaurant businesses to secure a good standard and the quality of the food.

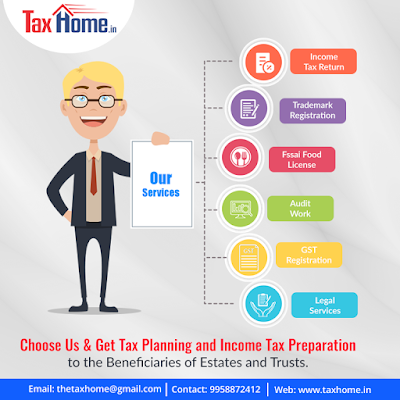

The process of getting FSSAI license is quite easy. You can approach a legal consultant that can help you to get the FSSAI license at an affordable cost in a small period of time. You can approach Tax Home for the convenient FSSAI registration in Delhi. Experts at Tax Home will give you the right consultation regarding your business, loans, compliances, etc. Without wasting time, run a successful business and expand it with the help of Tax Home.