Every business requires an accountant for its growth and development. A tally accountant helps the business to understand business and financial goals. Tally accountant is necessary for all types of business whether it is small or big. So, in this blog, I am going to share the reasons for why you need a tally accountant for your business.

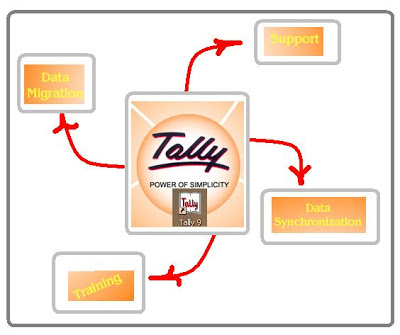

The tally accountants are helpful and have great experience in accounting and financial issues. They have a very good grip in accounting feature. They work with the best tally software, which is simple, and easy to operate and reliable with full business support. The capability and functioning of tally are wide and extended to a great content. It is becoming more popular than before. Let’s discuss the reasons below.

Here are some reasons for why you need a tally accountant for your business.

- Develop budget

A tally accountant helps the business to operate budget for their operations. The budget of the company created from various financial accounts. It helps the company to make the business decision fast and secure and also helps the business owners to understand better about the business and its resource.

- Save your time

You need to dedicate each minute you'll be able to the necessary work of developing your product and services to boost your profits. Having a tally accountant who will facilitate to check that you’ve filled in your forms properly, assist you to satisfy key deadlines and provide money recommendation can assist you to concentrate your efforts on what you are doing the best.

- Manage complex accounting tasks

A tally accountant manages the complexity of the tasks. They solve the complex accounting problems and ensure that no mistakes are made.

So, these are the reasons why you need a tally accountant for your business. If you are struggling with the finance part of your business, then you should hire a professional tally accountant for the growth of the business. Tax Home has the best and experienced tally accountants that provide effective business solutions in an effective and efficient manner. So, approach Tax Home and get the best tally accountant Delhi.

Blog Source :